Our partnership has the potential to bring added value to you and your customers. Use this calculator to forecast the growth potential by leveraging Chubb Studio capabilities.

Our partnership with NuBank, the world’s largest neobank, offers in-app insurance to over 100 million young customers. Policies are sold and serviced 100% digitally with monthly automated billing linked to Nubank customer bank accounts and credit cards.

Product:Term Life Insurance (incl. Personal Accident).

Solution:Embedded in-app (via APIs).

Premium:Starting at $2 per month.

Results:2 million policies in stock in 1.5 years. Disrupted the market, 80% customer less that 35 years old purchasing life insurance. NPS > 80.

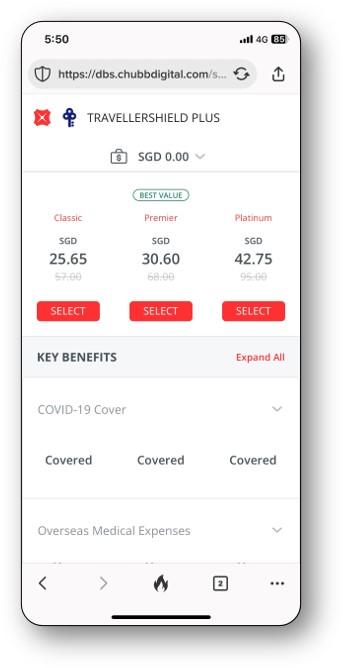

Our 15-year partnership with DBS provides an extensive range of insurance solutions to the bank’s customers and small and mid-sized businesses through multiple distribution channels.

Through collaboration and combined strengths in digitization, Travel Insurance is a hero product for all bank customers.

Product:DBS TravellerShield Plus

Solution:In-app, website and branch sales .

Premium:Premium is calculated based on Period of Travel, Destination, Type of plan (differs by sum Insured) and Add-ons (if any).

Claim:Claimants are encouraged to file their claims online and payments can be paid via PayNow, Bank Transfer or Cheque (if the claimant has no Singapore Bank Account) .

Mercado Libre (Meli) hosts the largest online e-commerce and payments ecosystem in Latin America, with 638m users, 200m online shoppers and 34m unique buyers.

Product:Cell phone insurance against damages and theft.

Solution:Embedded In-app (via APIs).

Premium:Dynamic pricing; premium varies based on brand and model.

Banco Falabella in Colombia positioned as the fourth largest issuer of credit cards and the first of Mastercard cards in the country. Chubb is integrated into the application flow to the credit card.

Product:Fraud (Card cloning protection and protected purchase).

Solution:Embedded in-app (via API), we compete with another insurer within the same integration leading the sale.

Premium:USD $7 per month on average.

Our partnership with Grab provides innovative in-app insurance solutions across Southeast Asia to millions of passengers, drivers and merchants using the power of Grab’s ecosystem and Chubb’s insurance expertise.

Product:Ride cover(Personal Accident + Taxi Delay).

Ride Cover fee:S$0.35/USD 0.08

Claim:Policy says out for Personal Accident & Medical Expernses reimbursement. Instant $5 pay-out parametric claims for Driver Delay.

Solution:In-app. Secure API interration for full lifecycle from quotation, payment, policy issuance, self-service and claims. Integrations with Grab payments:GrabPay, Driver Wallet, Grab Subscriptions.

Results:Over 150 million rides protected in 20 months.

Banamex is the leading financial group in Mexico. Following a universal banking strategy, the Group offers a variety of financial services to corporate and individuals, including commercial and investment banking, insurance and investment management.

Product:Auto insurance, with theft and damage coverages for the vehicle, personal liability, medical expenses, and legal assistance to policy holder plus critical road and travel assistances.

Ride Cover fee:S$0.35/USD 0.08.

Solution:Embedded in-app (via APIs).

Premium:USD $275 per year on average.

Banco de Chile is the largest bank based in Chile, signed in 2018. It maintains and grows a diverse user mix: 2 million customers in Personal Banking, 121k SMEs, 16k Corporate.

Product:Home Insurance with AI coverage recommendation engine.

Solution:Embedded In-app (via API).

Premium:Dynamic premium based on home characteristics.

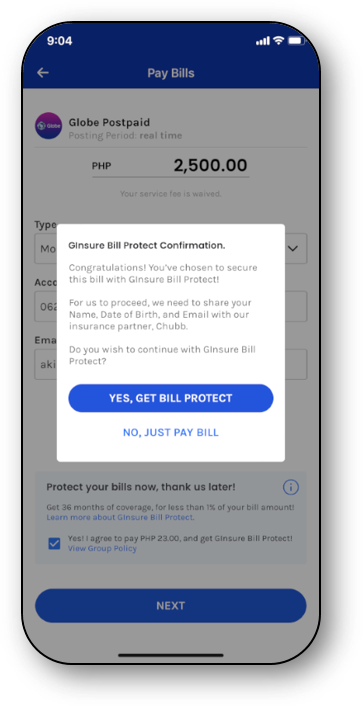

GCash is a leading e-wallet in the Philippines, building a cashless ecosystem with over 60m users and more than 63k partner merchants. Our partnership enabled them to seamlessly offer relevant and affordable “micro insurance” to a population with historically low insurance rates.

Product:Online Shopping Protect (Accidental Damage and Theft).

Solution:In-app

GCash is a leading e-wallet in the Philippines, building a cashless ecosystem with over 60m users and more than 63k partner merchants. Our partnership enabled them to seamlessly offer relevant and affordable “micro insurance” to a population with historically low insurance rates.

Product:Bill Protection (Accidental death & permanent disablement)

Solution:In-app. Secure API Integration

Premium:Dynamic pricing (1% of bill amount)

Claim:The group policy pays out a lump sum benefit which covers up to thirty-six months (three years) of the GCash bill payment amount at time of enrolment.

Ecuador's second largest bank with 2.7 million customers. We have a long-term alliance for the distribution of insurance in all its channels, Telemarketing, Face-to-Face and Digital.

Product:Account protection against money or identity theft and fraud.

Solution:Embedded in the web app, while customer is opening a new bank account.

Premium:Starting at $2.99 per month.

GCash is a leading e-wallet in the Philippines, building a cashless ecosystem with over 60m users and more than 63k partner merchants. Our partnership enabled them to seamlessly offer relevant and affordable “micro insurance” to a population with historically low insurance rates.

Product:Bill Protection (Accidental death & permanent disablement).

Solution:In-app

Premium:Dynamic pricing (1% of bill amount).

Claim:The group policy pays out a lump sum benefit which covers up to thirty-six months (three years) of the GCash bill payment amount at time of enrolment.

Banco Itaú is the largest bank in Latin America with more than 50 million customers. In partnership with Chubb, Itaú now offers a unique cell phone insurance program for its customers.

Product:Cell phone protection against damages and theft.

Solution:Embedded in-app (APIs).

Premium:Dynamic pricing; premium varies by make, model, and capacity.

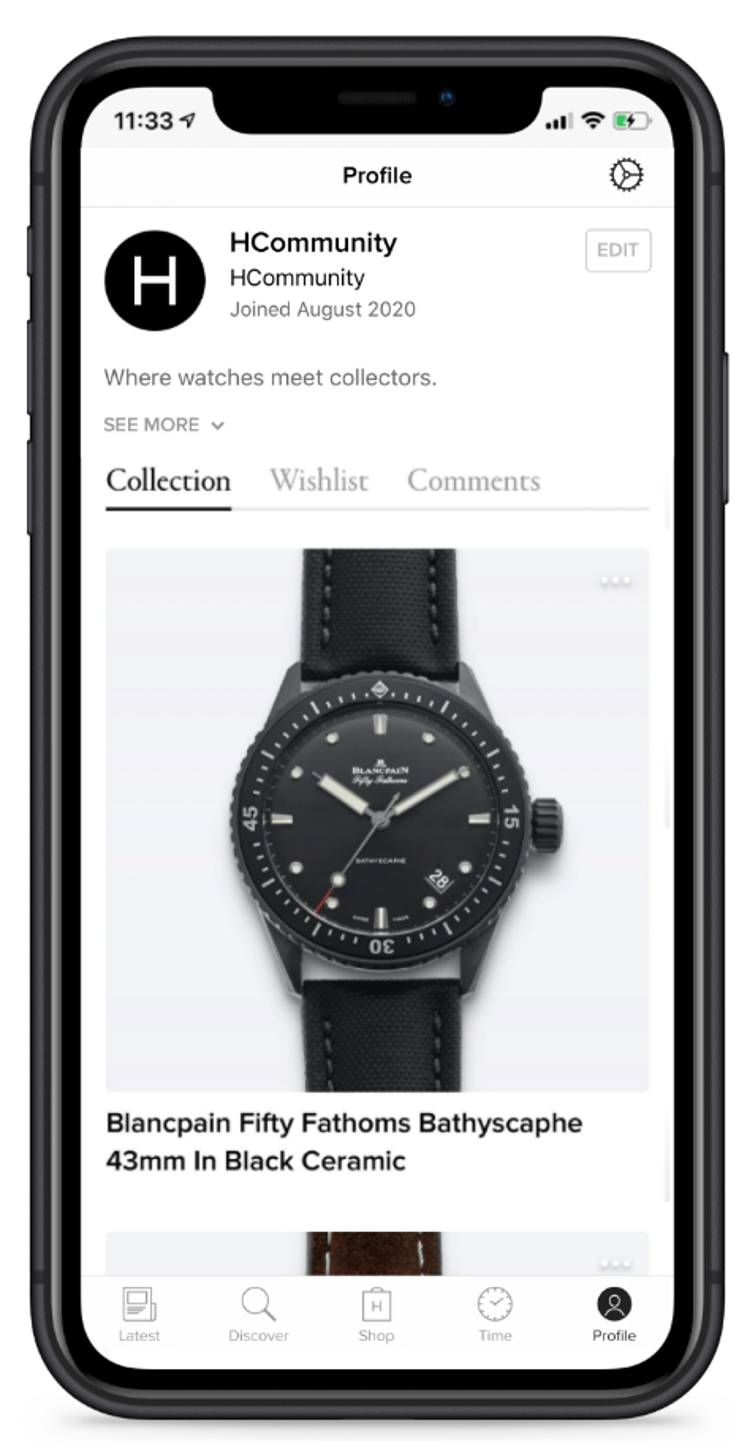

Hodinkee is the preeminent resource for modern and vintage wristwatch enthusiasts online. Based in New York City, Hodinkee is one of the most trusted timepiece and accessories retail platforms for consumers and enthusiasts alike. Hodinkee is also a robust media platform, providing its respected point of view on industry news and releases.

Product:All-risk valuable articles policy

Coverage:World-wide coverage with inflation protection and no deductible

Solution:Embedded in-app (via APIs)

WAX Insurance Services specializes in making insuring valuables easier and more efficient for everyone. Wax is a trusted easy-to-use platform for owners of luxury items such as watches, jewelry, handbags, art, and collector cars, to purchase insurance and unlock liquidity in their collections. Users can catalog their valuables into a digital wallet using an Apple or Android device.

Product:All-risk valuable articles policy

Coverage:World-wide coverage with inflation protection and no deductible

Solution:Embedded in-app (via APIs)

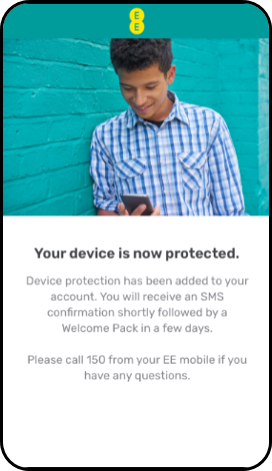

Chubb’s mobile phone insurance helps EE’s customers’ stay connected! EE’s mobile phone insurance is a comprehensive cover that provides customers with worldwide cover against accidental damage, breakdown, loss, and theft. EE customers have peace of mind knowing their phone will be repaired by manufacturers authorised repairers only, and their customers can also pop into their local EE store for a quick repair. For lost or stolen phones, EE customers could even get a next day replacement– helping them re-connect quicker!.

Product:Mobile Phone protection (Accidental Damage, Loss and Theft)

Solution:Embedded in-app (via APIs)

Results:500K+ policies. By offering this cover, EE has provided its customers with much valued protection for an everyday essential. More than half a million customers have had their mobile phone repaired or replaced using EE mobile phone insurance – just one of the ways EE is there for its customers!

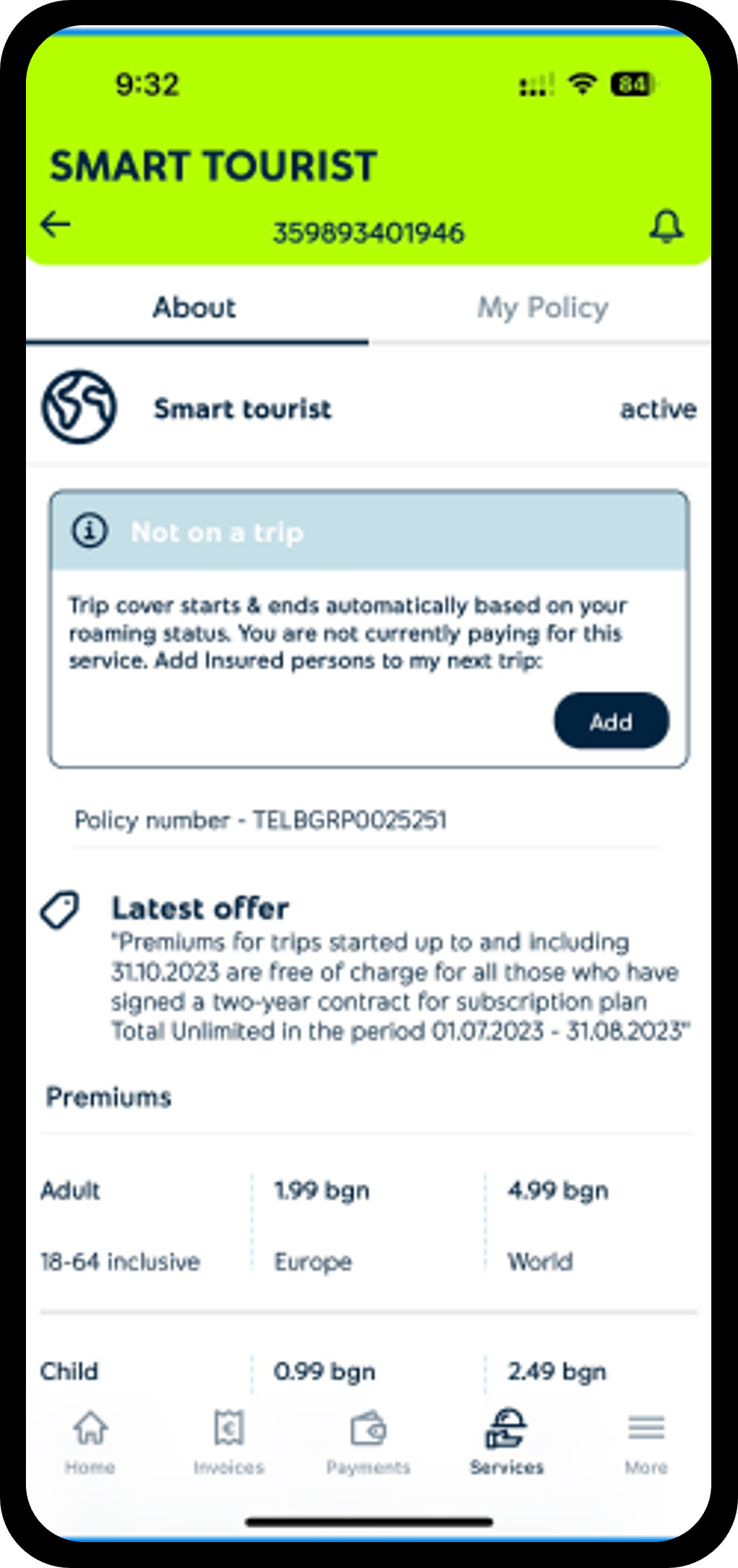

Travel insurance made easy: Yettel Bulgaria’s! Yettel Bulgaria is a telecommunication company that connects over 3 million customers to people, devices, and businesses. It is part of PPF Telecom Group that operates in Bulgaria, Chechia, Hungary, Serbia and Slovakia. Yettel Bulgaria was formerly known as Telenor Bulgaria until 2022. In June 2020, Yettel, one of Bulgaria's leading mobile operators, became the first telecommunication company to offer Chubb's Pay As You Roam travel insurance product, marketed by Yettel Bulgaria as "Smart Tourist".

Product:Travel Insurance

Solution:Embedded in-app (via APIs). The insurance is activated automatically when the customer’s mobile number is detected in roaming and connects to a mobile network abroad. From this moment on, customers can choose to refuse the coverage for the respective trip or add up to 10 co-travelers to insure. The data can also be added in advance through the Yettel Bulgaria App. There is no activation fee for the insurance, and customers pay a daily premium only for the time they have been abroad with activated insurance coverage. Also, premiums are automatically added, for customers’ convenience, to their next invoice issued by Yettel, after the trip has ended.

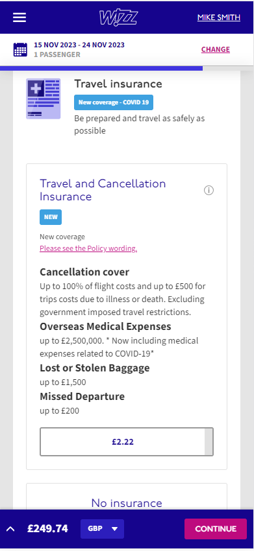

Chubb’s travel insurance helps Wizz Air’s customers’ stay protected!

Chubb has been Wizz Air’s travel insurance partner for the past 6 years and since then rolled out services in over 30 markets and serviced in 17 languages.

Product:Comprehensive

Trip Cancellation

Solution:Native integration into Airline’s booking & billing systems**

Channels:IBE, Manage My Booking

**Travel partners like Airlines are not using Chubb Studio tech but run on native CRS APIs, which are tailored by Chubb for the travel industry

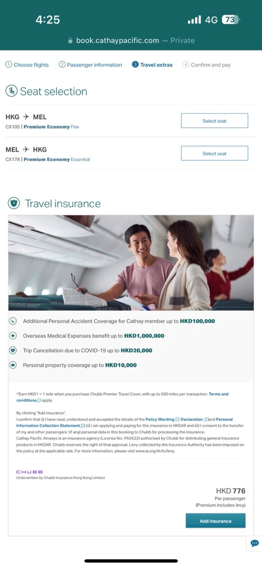

Cathay Pacific, one of Skytrax's world's top 10 airlines, is a premium airline based in Hong Kong. The airline operates an extensive network of over 80 destinations worldwide. Cathay Pacific has won numerous awards for its outstanding service, onboard experience, and commitment to sustainability, making it one of the world's most respected and trusted airlines.

In line with this vision, together we have launched tailor-made insurance solutions in 12 markets allowing us to offer passengers peace of mind and to make their journey even more enjoyable and hassle-free. and we are working on expanding & improving offerings further. We share the same vision to improve continuously including new products and new markets expansion.

Chubb & Cathay Pacific have also introduced an innovative campaign to offer Cathay members an opportunity to accumulate Miles every time they purchase an insurance policy. We continue to explore future initiatives to enhance customer experience by providing value-added services conveniently to members within the Cathay ecosystem.

Product:Chubb Premier Travel Cover (Single Trip and Annual Multi Trip Cover)

Solution:Integrated in-path**

Standalone website

**Travel partners like Airlines are not using Chubb Studio tech but run on native CRS APIs, which are tailored by Chubb for the travel industry

GCash is a leading e-wallet in the Philippines, building a cashless ecosystem with over 60m users and more than 63k partner merchants. Our partnership enabled them to seamlessly offer relevant and affordable “micro insurance” to a population with historically low insurance rates.

Product:Online Shopping Protect (Accidental Damage and Theft).

Solution:In-app